Aramid fiber, carbon fiber, and ultra-high molecular weight polyethylene fiber are known as the three major high-performance fibers. They are widely used in the defense, military, and civilian fields and are strategic materials for strengthening the country and the army.

In the field of aramid, DuPont not only has the first-mover advantage in technology and market, but also is good at using patent resources to consolidate and strengthen its advantages, continuously expand the industrial chain, and squeeze the living space of weak enterprises.

For many years, my country’s aramid enterprises have been struggling to survive in the cracks and urgently need to break through. This article hopes to provide suggestions for the development of my country’s aramid enterprises by analyzing DuPont’s patent layout.

At present, there are two types of aramid products with the most practical value: (1) meta-aramid, whose chemical name is “poly(m-phenylene isophthalamide)” fiber, known as aramid 1313 in my country;

(2) para-aramid, whose chemical name is “poly(p-phenylene terephthalamide)” fiber, known as aramid 1414 in my country. The two have similar chemical structures, but their performances are very different and their application fields are different.

Meta-aramid has outstanding high-temperature resistance, flame retardancy, and insulation, and is mainly used in high-temperature protective clothing, electrical insulation, and high-temperature filtration.

Para-aramid has the characteristics of high strength and high modulus and is known as the “transformer” among polymer materials. It is mainly used in personal protection, bulletproof armor, optical cables, friction sealing materials, rubber products, high-strength cables, etc.

Aramid fiber was first successfully developed and industrialized by DuPont in the United States in the 1960s.

After 60 years of development, DuPont Aramid has become increasingly mature in terms of R&D level and large-scale production and has occupied a monopoly position in technology and the market.

At present, the global production of para-aramid has reached 80,000 tons and the production of meta-aramid has reached 40,000 tons.

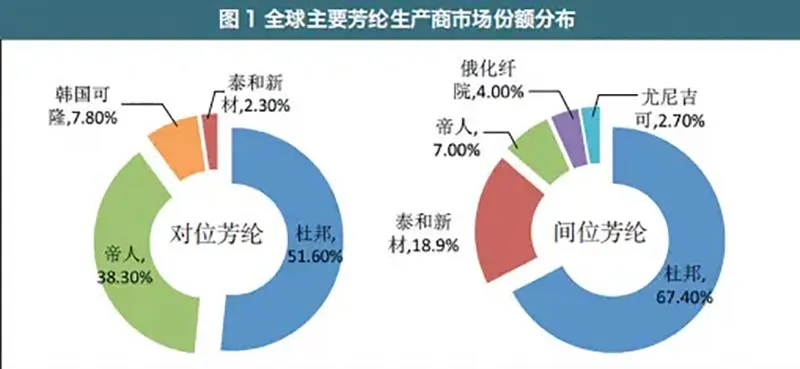

Among them, DuPont’s para-aramid and meta-aramid market share accounted for 51.6% and 67.4% respectively, Japan’s Teijin Company’s market share in para-aramid reached 38.3%, and the domestic enterprise Taihe New Materials’ meta-aramid market share ranked second in the world (see Figure 1).

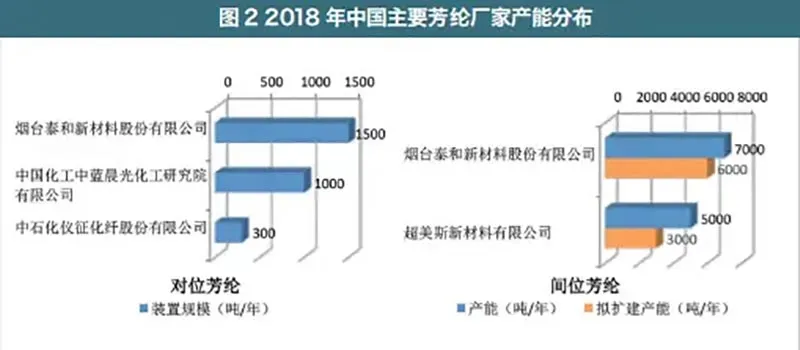

My country’s aramid fiber technology started late, and the main production capacity is distributed in 5 enterprises (see Figure 2). In terms of varieties, meta-aramid and para-aramid have different development levels.

Meta-aramid is relatively mature and has formed scale production capacity, while para-aramid is heavily dependent on imports. My country began to develop aramid in the 1970s.

During the “12th Five-Year Plan”, meta-aramid achieved a technological breakthrough. In 2018, my country’s total meta-aramid output was about 12,000 tons.

Representative enterprises include Yantai Taihe New Materials Co., Ltd. and Chaomeis New Materials Co., Ltd.; breakthroughs in key equipment, products, and application industrialization technologies of para-aramid are important tasks during the “13th Five-Year Plan”.

In 2018, there were 3 para-aramid enterprises above the designated size in my country, with an output of about 1,800 tons, and domestic demand was about 10,000 tons. The demand gap was filled by imports.

Through the Incopat database search, as of March 12, 2020, a total of 3,353 aramid fiber patents disclosed by DuPont were retrieved. After a simple family merger, 1,287 patents in the same family were obtained.

DuPont’s patent application in the field of aramid began in 1957 and has continued to this day (see Figure 3).

On February 28, 1957, DuPont applied for the first patent US03642941 involving the synthesis of high molecular weight aromatic polyamide from aromatic diamines and aromatic diacyl halides.

For the first time disclosed a method for preparing fibers by spinning a solution of dimethylacetamide containing lithium chloride with m-phenylenediamine/p-phenylenediamine and isophthaloyl chloride.

Before 1980, DuPont had completed the research and industrial production of m-aramid and p-aramid.

With the industrialization of Teijin’s m-aramid in Japan and the gradual development of aramid research in other countries, DuPont began to carry out large-scale patent layouts in the field of aramid fibers in the 1980s in order to consolidate the market.

Entering the 21st century, the aramid markets in South Korea and China gradually rose, and DuPont once again strengthened its own aramid patent layout system.

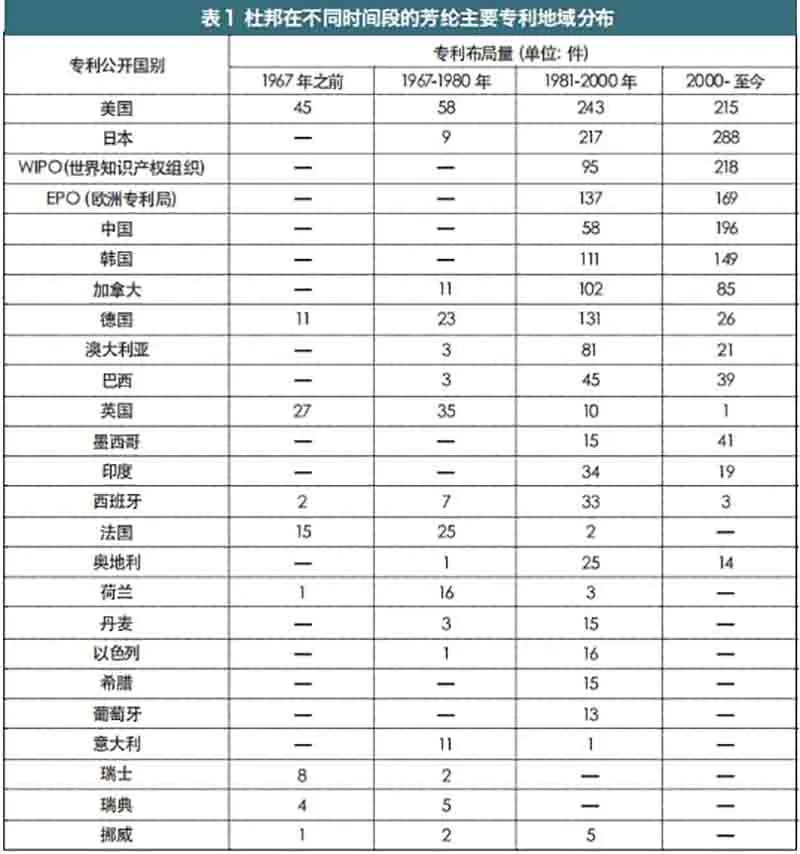

From the market perspective (see Table 1), before the industrialization of meta-aramid, DuPont’s patent layout was concentrated in the United States, Germany, the United Kingdom, France, and a few European countries; between 1967 and 1980.

DuPont further expanded its patent layout in Europe and began to deploy patents in Canada and Japan; between 1981 and 2000, the trend of aramid internationalization gradually emerged.

DuPont not only further consolidated its market position in the United States and strengthened its patent layout in Germany and Canada but also faced the rise of the aramid industry in Japan and South Korea.

DuPont also carried out a large number of patent layouts in Japan and South Korea and actively applied for overseas patents through the Paris Convention and PCT (Patent Cooperation Treaty).

Entering the 21st century, with the rise of emerging markets in Asia, DuPont’s patent layout in overseas markets began to shift from Europe to Asia, focusing on a large number of patent layouts in Japan, China, and South Korea, and seizing the market through patent layouts.

From a technical perspective, as time goes by and the market matures, DuPont’s patent layout in the aramid industry has gradually shifted to the downstream of the industrial chain.

Before the industrialization of meta-aramid, the patent layout was mainly focused on the preparation of polymers and the research and development of production processes.

After that, the attention on the preparation methods of compounds gradually decreased, and the focus began to tilt towards production processes and application areas; after 1980, production processes, products, and application areas became the focus of patent layout, with more emphasis on production process research;

After entering the 21st century, the patent layout for the aramid industry began to shift from research on production processes to products and application areas (see Table 2).

Through the above analysis, we can find that for its technologies and products, DuPont adopts a patent layout strategy that covers all major markets and the entire industrial chain.

That is, based on the maturity of market development, on the basis of consolidating the domestic market, it gradually expands overseas markets and focuses on grasping the main markets; based on the maturity of technological development, the patent layout gradually transitions from the upstream to the downstream of the industrial chain.

In 1985, the first year that the Patent Law was officially implemented in my country, DuPont began to develop patents for aramid in my country. Its first patent in China, CN85107011.6, involved “high-throughput aromatic polyamide reverse osmosis membrane and its manufacturing process”.

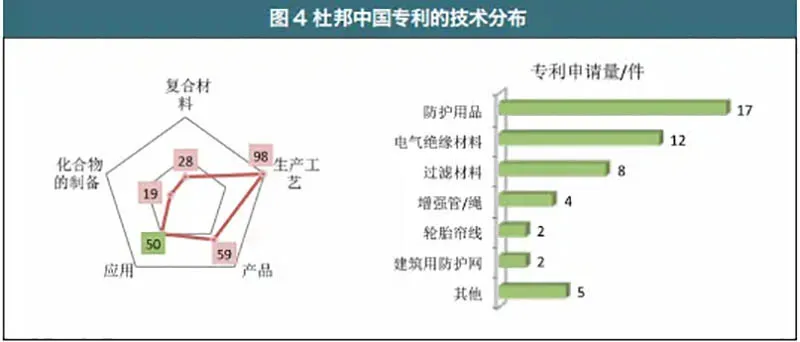

At present, DuPont has accumulated 254 patents related to aramid in China. The patented technologies include the preparation of compounds, composite materials, production processes, products, and applications.

The focus of the layout is mainly on production processes, followed by products and applications; from the perspective of application areas, it is mainly concentrated on protective equipment, electrical insulation materials, and filter materials.

This is consistent with the fact that domestic aramid fibers are mainly used for industrial filtration, protection, and electrical insulation. In addition, DuPont also has certain patent layouts in tire cords, high-strength ropes, pipes, and protective nets for intercepting falling rocks (see Figure 4).

It can be seen that DuPont’s patent layout in my country focuses on industrial production and downstream applications.

By grabbing patents, it restricts Chinese companies’ production and manufacturing of aramid fibers and effectively controls China’s aramid market.

In the downstream of the industrial chain, it focuses on the application of aramid fibers in protective equipment, electrical insulation materials, and industrial filter materials, curbing the cooperation between downstream manufacturers in the industrial chain and domestic aramid fiber companies.

In addition to patent layout for its own technology, products, and target markets, DuPont also adopted certain patent layout strategies to hinder the development of competitors.

For example, it took advantage of the loopholes in the patent layout of competitors and carried out peripheral patent layouts around their basic core patents to form a patent fence and block the way for competitors to extend their development downstream of the industrial chain.

Aromatic sulfone is a domestically produced high-performance fiber with independent intellectual property rights. Its polymer has 75% para structure and 25% meta-structure and contains sulfone group (- SO2-) on the main chain.

It belongs to the same aromatic polyamide fiber as aramid 1313 and aramid 1414. Compared with DuPont’s Nomex, aromatic sulfone has more excellent performance and is expected to completely replace Nomex and break the technical monopoly of developed countries in the field of high-temperature-resistant fibers.

In March 2006, Shanghai Textile Holdings (Group) Co., Ltd. (hereinafter referred to as “Shanghai Textile Holdings”) registered and established Shanghai Teanlun Fiber Co., Ltd. (hereinafter referred to as “Teanlun Company”) as the operating entity of the sulfonamide industrialization project.

In 2007, when Teanlun was preparing to go into production, DuPont intended to acquire the technology. After being rejected, DuPont carried out a patent layout in a containment style for the basic core patents of Teanlun.

In 2007 alone, DuPont laid out 17 patents around sulfonamide (14 of which were patent layouts for the downstream of sulfonamide), namely, patent CN200710097134.

X laid out in China on April 12, 2007, 10 patents applied for in the United States on August 22, 2007, and 6 patents applied for in the United States on December 21, 2007. With these 17 patents as a priority, 17 patent families have been formed.

Among these 17 patent families, except for the three patent families with priority numbers US11894913, US11894939, and US11471907, which did not cite the patents of Shanghai Textile Control, the other 14 patent families all cited the patent CN02136060.

X (method for manufacturing aromatic polysulfone amide fiber) applied by Shanghai Textile Control on July 6, 2002. CN02136060.

X is the first patent related to aromatic sulfone fiber applied by Shanghai Textile Control and is an important patent related to the method for manufacturing aromatic sulfone fiber, which is still valid.

The core patent CN200710038474.5 (method for manufacturing all-meta-aromatic polysulfone amide fiber) of Teanlun Company is an improved patent of Shanghai Textile Control’s patent CN02136060.X (see Table 3).

The monomers for preparing sulfone fiber are 3,3′-DDS or 4,4′-DDS. The patents laid out by DuPont in 2007 are all based on these two monomers, which are mixed with other materials to form flame retardant, filtering, insulating, and other materials.

14 of the above 17 patent families have similar patents in China, and 7 patents in the application fields of ventilation pipes, flame retardant materials, filtering materials, and sulfone paper are still valid.

Due to DuPont’s dense patent layout downstream of the sulfonamide industry chain, although Teanlun has patents and has no problem producing sulfonamide raw materials upstream, its entry into the downstream industry of sulfonamide will be hindered.

Downstream-related companies cannot purchase the sulfonamide produced by Teanlun for production and use, otherwise, they may infringe on DuPont’s patent rights. This ultimately prevented Teanlun from achieving the expected sales performance.

While Chinese aramid enterprises are working hard to innovate and try to cross the technical barriers and market barriers of foreign industry leaders, it is very important to effectively protect their innovative technologies through patent layout.

Based on the analysis of DuPont’s patent layout strategy, the author makes four suggestions for Chinese aramid enterprises to carry out patent layout: Know yourself and know your enemy, and you will never be defeated in a hundred battles.

Enterprises should make full use of existing patent technology information, retrieve and analyze patent information, especially analyze the patents of industry leaders and competitors, understand the latest technological trends and the patent situation of competitors, and guide their technology research and development and future patent layout.

For example, when a patent that may infringe on the patent rights of competitors is retrieved, the enterprise should carry out a reasonable circumvention design for the patent technology.

Circumvention design can not only effectively avoid patent infringement, but also is an effective research and development means. Before troops move, food and grass must be prepared. The patent layout is a planned and strategic patent mining and deployment behavior.

When enterprises carry out patent layouts, they should take into account multiple dimensions such as technology development, product application, and market planning to form a comprehensive patent layout of “basic patents + peripheral patents”.

In the actual operation of enterprises, it is necessary to formulate plans and processes for patent layout, and implement them strategically and step by step, rather than applying in a scattered and blind manner.

For example, a patent application should be submitted before a product is launched to avoid information disclosure that undermines the novelty of the patent; before applying for a patent, a technical search should be done to avoid the phenomenon of improperly drafted claims and being unable to be authorized.

Target the market and seize the position with patents. In the development positioning, for the target markets that are of particular concern, enterprises should have a forward-looking patent layout mindset.

Plan the focus of patent layout according to the technology and industrial development of the target market, and use patent layout to achieve key breakthroughs and seize the market.

Find loopholes and block them in time. It is important to protect your innovative technologies and products, but it is equally important to prevent competitors from expanding their markets.

You should pay real-time attention to your competitors’ patent layouts, analyze and find loopholes in their patent layouts, and make patent layouts based on their loopholes, which can effectively curb them.

Source: The author’s Textile Science Research was published in Textile Express

As we know, Heat Transfer Printing Felt is suitable for fabrics, decorative fabrics, curtains, le...

Read Safety Rules for Laundry Management to be a qualified manager. PARTⅠ Laundry room Safety Gen...

The aluminum extrusion machine is the leading equipment for the production of aluminum profiles. ...

Heat transfer printing is a contemporary printing process in the clothing market. It prints the p...

In the textile industry, felt is only a small part but important. About how to choose felt that i...

Foshan Pure Technology Company., Ltd. helps conveyor belt manufacturers source equipment to metal...

What is Nomex? Meta-amide, or meta-phenylene isophthalamide, is made from meta-phenylenediamine a...

Kevlar fiber Introduction In the development of materials science, Kevlar fiber has particularly ...